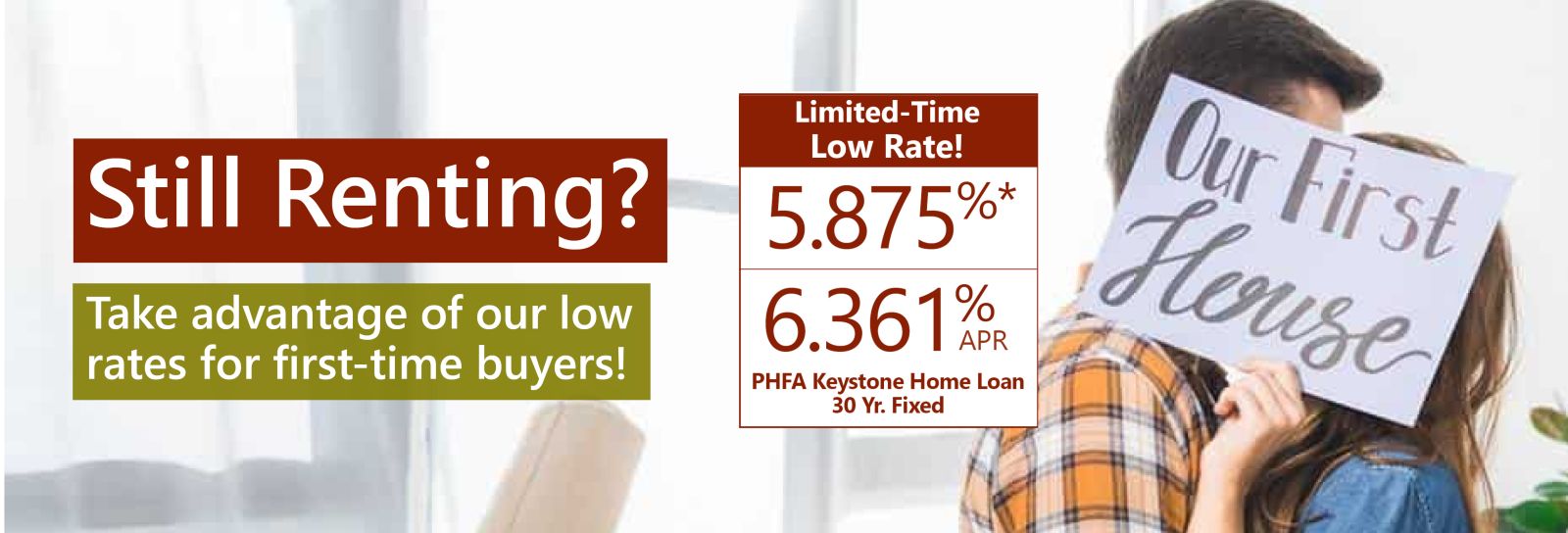

The Pennsylvania Housing Finance Agency’s, (PHFA’s) rate on its Keystone Home Loan Program is currently 5.875%! This low rate is significantly lower than the current conventional 30-year interest rate and is only available until funds run out so buyers should act quickly!

For those who qualify, the Keystone Home Loan Program also offers a 3% down payment option and an available zero percent interest second mortgage to help with down payment and closing costs! Qualified buyers can receive up to 4% or $6,000 (whichever is less) of the purchase price or market value of the home to be repaid over 10 years. This incentive adds another option that can bring homeownership into financial reach!

Hurry, this low rate is only available for a limited time!

PHFA Keystone Home Loan Program Features:

- ONLY 3% minimum down payment!

- Conventional 30-year fixed mortgage (FHA, USDA & VA options also available)

- Primarily for first-time buyers and repeat buyers in certain areas.

- Seller assists permitted.

- Purchase price and income limits apply.

- 1-2 unit and condos allowed.

- Homebuyer education class may be required.

- Property must meet PHFA's property guidelines. Call for details.

*Rate effective 3/6/2025 and is subject to change. Property must be in Pennsylvania and meet PHFA guidelines, including purchase price limits. Rate and Annual Percentage Rate (APR) based on $300,000 purchase price with 3% down with total monthly principal and interest payment payment of $1,721.37 for 360 months. Payment does not include taxes and insurance.